Illicit Oil and Gasoline Markets in Latin America: Typology and Sociopolitical Factors

By Héctor Briceño.

Latin America's oil production has increased significantly in recent years, positioning it as a pivotal player in global markets in the forthcoming decade. Alongside traditional producers such as Brazil, Mexico, and Venezuela, countries like Colombia, Argentina, Ecuador, and Guyana have witnessed a considerable increase in their production levels in recent decades.

According to World Bank statistics, oil production has increased to play a central role in the region's economy. For example, in 2021, the sector accounted for 22% of GDP in Guyana, 6.4% of GDP in Ecuador, 2.6% of GDP in Brazil, 2.1% of GDP in Mexico, and 1.5% of GDP in Argentina. Concurrently, consumption levels have increased, with estimates indicating that over 70% of Latin American oil production is consumed within the region, while the remainder is exported to markets in the United States, Europe, India, and China, among others.

The persistent institutional weakness of Latin American states (Mainwaring and Pérez-Liñán, 2023; Mazzuca and Munck, 2021), the permeability of national borders, as well as the presence of significant economic, political, and social incentives (Dewey and Thomas (2022) posits that the ease of movement across national borders and the lack of robust institutional frameworks facilitate the illicit trade of petroleum and gasoline, fueling a considerable market that is shaped by the intricate interactions between a diverse array of actors, including state institutions and criminal organizations (Beckert & Dewey, 2017).

A number of questions remain unanswered regarding the operation of illicit oil and gasoline markets. These include: What are the main routes and methods used to smuggle oil and gasoline in Latin America? Which actors play a key role within the complex network of oil and gasoline smuggling? What are the boundaries between the illegal and legal oil trade markets? How do different actors insert themselves into these markets? What factors incentivize their participation? It is important to consider the impact of these illicit activities on the region's economy, environment, and social structure.

Objectives

Despite the growing importance of the oil market in the region and the simultaneous growth of the illicit oil and gasoline markets, the academic literature on this topic is limited. Therefore, this study aims to address this gap by:

§ Developing a typology of illegal oil and gasoline markets in Latin America,

§ Identifying the roles played by the diversity of actors involved in the illicit oil and gasoline market, and,

§ Analyzing how criminal governance dynamics are built.

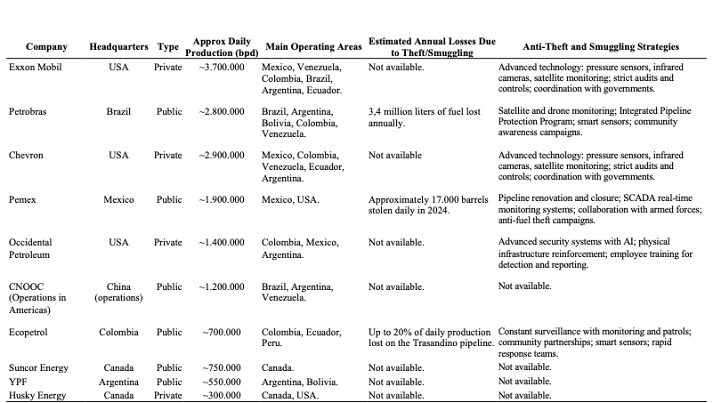

Table 1. A typology of illegal oil and gasoline markets in Latin America

Table 2. Geographical Distribution of Illicit Oil and Gasoline Markets in Latin America

Note: The table has been generated with AI support.

Referencias

§ Dadpay, A. An Analysis of Fuel Smuggling in the Middle East as a Single Multinational Market. J Ind Compet Trade 20, 643–656 (2020). https://doi.org/10.1007/s10842-020-00340-6

§ Dewey M, Thomas K. Futurity Beyond the State: Illegal Markets and Imagined Futures in Latin America. Latin American Politics and Society. 2022; 64(4):1-23. doi:10.1017/lap.2022.24

§ Hogenboom, B. Depoliticized and Repoliticized Minerals in Latin America. Journal of Developing Societies, 28(2), 133-158. (2012). https://doi.org/10.1177/0169796X12448755

§ Mainwaring, Scott and Aníbal Pérez-Liñán. "Why Latin America's Democracies Are Stuck." Journal of Democracy, vol. 34 no. 1, 2023, p. 156-170. Project MUSE, https://doi.org/10.1353/jod.2023.0010

§ Mazzuca S and Munck G. Middle-Quality Institutional Trap: Democracy and State Capacity in Latin America. Cambridge University Press; 2021.

§ Munck, Gerardo. Democracias duraderas de baja calidad en América Latina. University of southern California (2023) https://www.researchgate.net/publication/375576970_Democracias_duraderas_de_baja_calidad_en_America_Latina

§ Smile, David and Camilo Nieto-Matiz. Criminal Governance in Latin America: Emerging Agendas. Dossier. LASA Forum, 53–4 (2022).

§ Urciuoli, L. Fuel theft in road freight transport: understanding magnitude and impacts of anti-theft devices. J Transp Secur 13, 1–18 (2020). https://doi.org/10.1007/s12198-020-00207-1

§ Williams, P. Illicit markets, weak states and violence: Iraq and Mexico. Crime Law Soc Change 52, 323–336 (2009). https://doi.org/10.1007/s10611-009-9194-0

Other sources

§ OpenAI. (2025). llicit Oil and Gasoline Markets in Latin America. ChatGPT. https://chat.openai.com/§ https://www.statista.com/statistics/1454576/volume-fuel-loss-theft-mexico

§ https://insightcrime.org/news/brief/mexico-state-oil-company-lost-billion-theft-2016

§ https://www.statista.com/statistics/1454576/volume-fuel-loss-theft-mexico

§ https://gsi.s-rminform.com/articles/security-challenges-in-mexicos-oil-and-gas-sector

§ https://www.opportimes.com/pemex-loses-1040-mp-due-to-fuel-theft

§ https://www.opportimes.com/pemex-drops-30-4-fuel-theft

§ https://www.pemex.com/en/press_room/press_releases/Paginas/2019-014-national.aspx

§ https://mexiconewsdaily.com/news/pemex-losses-from-fuel-theft-escalated-in-2022

§ https://mexiconewsdaily.com/news/petroleum-theft-cost-pemex-147-billion

§ https://mexiconewsdaily.com/news/fuel-theft-on-rise-again

§ https://mexiconewsdaily.com/news/fuel-theft-on-rise-again

§ https://www.ejecentral.com.mx/huachicol-le-costo-18-7-mil-mdp-a-pemex-en-2022

§ https://www.opportimes.com/pemex-loses-1040-mp-due-to-fuel-theft

§ https://www.eluniversal.com.mx/cartera/crimen-controla-30-del-gas-lp

Annual Reports by Company

§ ExxonMobil 2025: https://investor.exxonmobil.com/sec-filings/annual-reports

§ Petrobras: https://petrobras.com.br/en/sustentabilidade/relatorios-anuais

§ Chevron: https://www.chevron.com/annual-report

§ Pemex: https://www.pemex.com/en/investors/publications/Paginas/petroleum-statistics.aspx

§ Occidental Petroleum (Oxy): https://www.oxy.com/investors/financial-information/annual-reports/

§ CNOOC (Operations in the Americas): https://www.cnoocltd.com/english/investorrelations/reports/annualreport/

§ Ecopetrol: https://www.ecopetrol.com.co/wps/portal/Home/en/investors/financial-results/sec-filings

§ Suncor Energy: https://www.suncor.com/en-ca/investors/financial-reports-and-guidance

§ YPF: https://investors.ypf.com/Financial-information.html

§ Husky Energy (merged with Cenovus): https://www.cenovus.com/~/link.aspx?_id=2097DABD3167437CBAB903FC28CAF5CA&_z=z&utm_

Comentarios

Publicar un comentario